Business Insurance in and around Prosper

Calling all small business owners of Prosper!

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including business continuity plans, worker's compensation for your employees and extra liability coverage, among others.

Calling all small business owners of Prosper!

Cover all the bases for your small business

Protect Your Business With State Farm

Whether you own an arts and crafts store, a clock shop or a bakery, State Farm is here to help. Aside from great service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

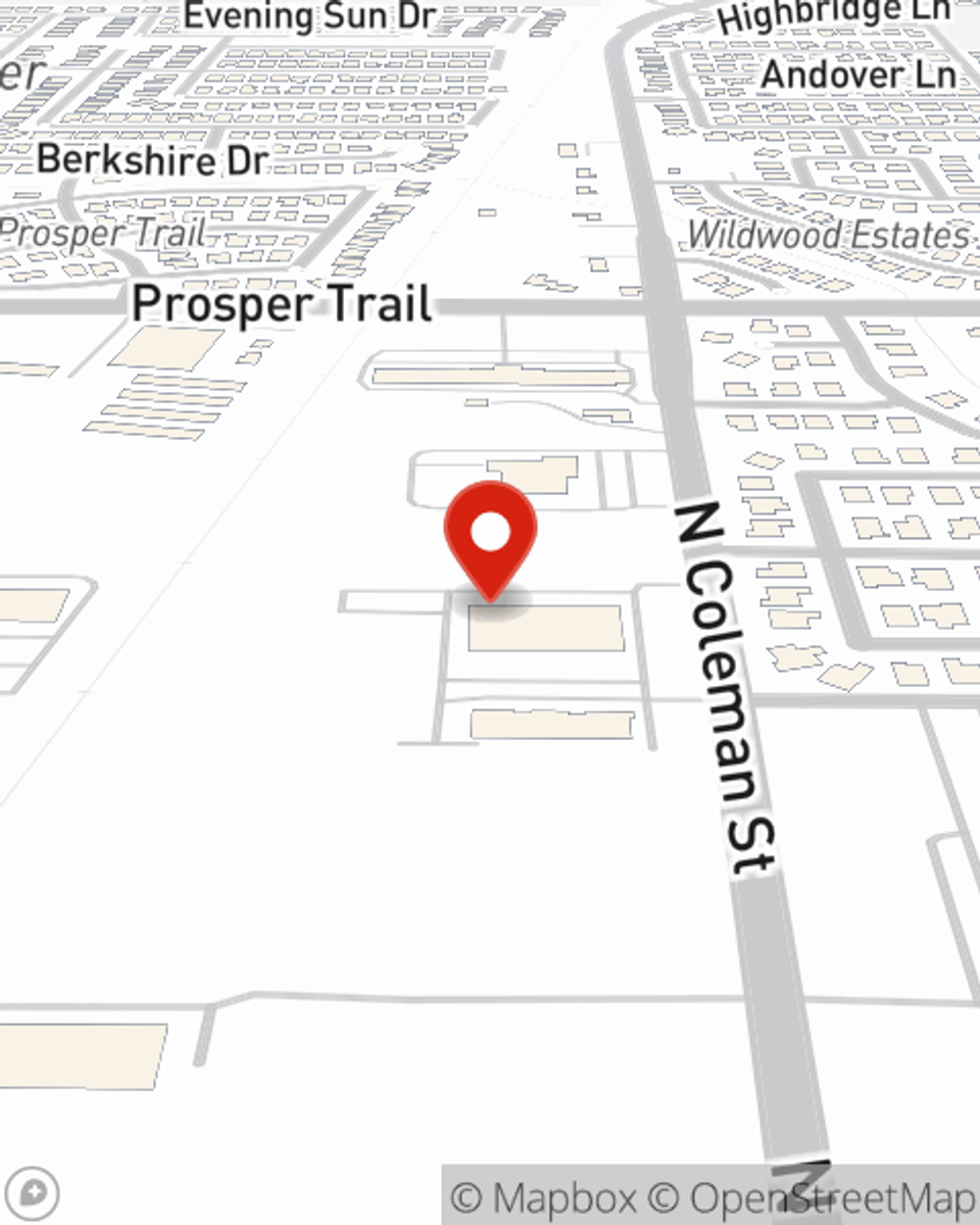

Ready to explore the business insurance options that may be right for you? Visit agent Christian Lett's office to get started!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Christian Lett

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.