Renters Insurance in and around Prosper

Get renters insurance in Prosper

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented space is home. Since that is where you rest and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your bed, golf clubs, pots and pans, etc., choosing the right coverage can help protect your belongings.

Get renters insurance in Prosper

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

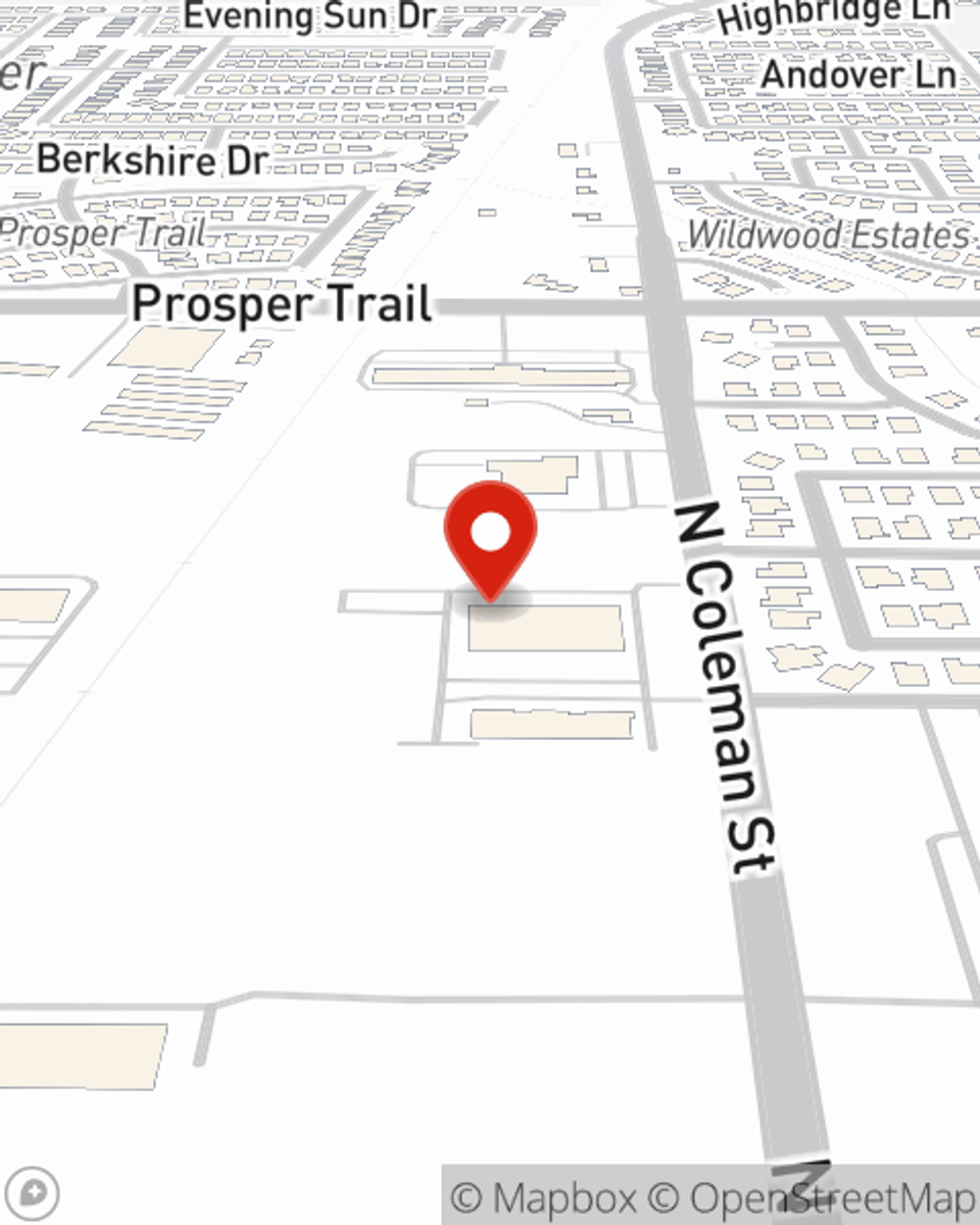

It's likely that your landlord's insurance only covers the structure of the space or townhome you're renting. So, if you want to protect your valuables - such as a couch, a bicycle or a tool set - renters insurance is what you're looking for. State Farm agent Christian Lett has a true desire to help you evaluate your risks and keep your things safe.

Reach out to Christian Lett's office to find out how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Christian at (972) 346-1638 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Christian Lett

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.